Pension discount rates have plummeted over the past few months and plan sponsors should prepare for a potential upward spike in balance sheet liabilities for the fiscal year ended December 31, 2011.

Using the Citigroup Pension Discount Curve (CPDC) as a proxy, pension accounting discount rates could decrease by 100 basis points (or more). This will mean a big increase in the pension liability and net balance sheet liability for many plans.

Analysis

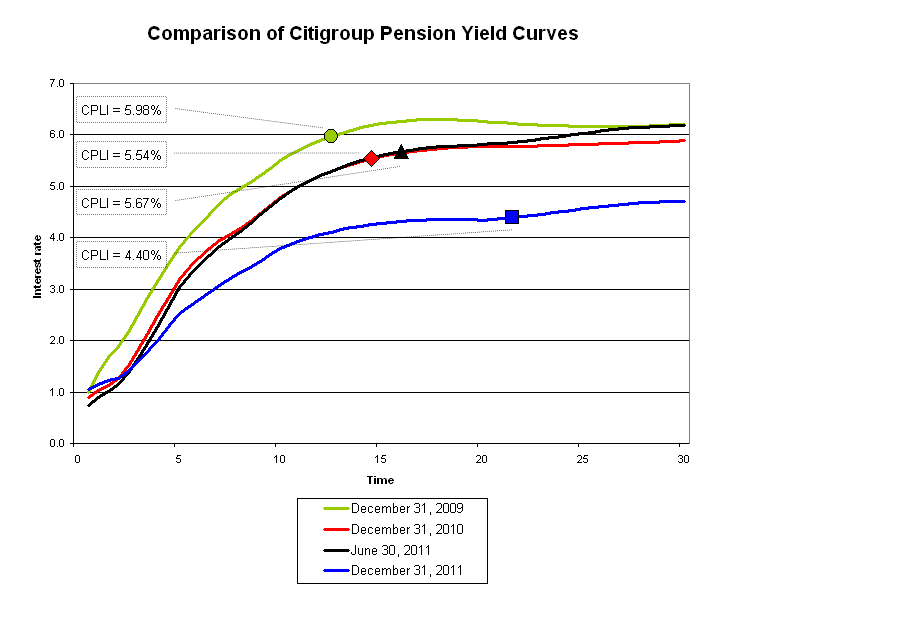

In the chart below we compare the CPDC over the past two years at different dates (12/31/2009, 12/31/2010, 6/30/2011, and 12/31/2011). We also highlight the Citigroup Pension Liability Index rate (CPLI) at each measurement date. The CPLI can be thought of as the average discount rate produced by the curve for an average pension plan.

On the short end of the spectrum, rates continued to drop between FYE2009 and FYE2011. The bigger issue may be the dramatic drop in rates on the long end of the spectrum (e.g., years 15 and beyond) since 6/30/2011.

A large portion of many pension plansf obligations are discounted at these long-term rates, so they could have a significant impact on the accounting liabilities. This is particularly true for retiree medical plans where assumed health inflation means that considerably higher costs are projected in the later years.

Net Effect on Balance Sheet Liability

If asset performance was weak during 2011, then this will exacerbate the situation since the net shortfall (assets minus liabilities) is reported as the balance sheet liability.

Below is a simplified illustration for a plan that was 90% funded on 12/31/2010 and we assume a 10% increase in pension liability during 2011. We then compare the funded status results under two asset scenarios: (1) Level assets since 12/31/2010 and (2) Assets 5% lower than 12/31/2010.

Depending on the starting funded status, the change in pension liabilities and assets can have a dramatic leveraging effect on the reported balance sheet liability.

Conclusions

So, whatfs a plan sponsor to do when faced with a big increase in pension accounting liability? Here are a few ideas.

- Your planfs specific cash flows could have an enormous impact on how much the drop in fixed income rates affects the pension liability. If youfve just used the CPLI in the past, itfs worth looking at modeling your own projected cash flows with the CPDC to see how it stacks up.

- If youfve implemented an LDI strategy for a portion of the pension trust portfolio, then the drop in discount rates should be accompanied by a corresponding increase in your asset value. If you havenft adopted an LDI investment strategy yet, now may be a good time to revisit this policy.

- There are lots of alternatives to the CPDC and CPLI as a basis for setting accounting discount rates. Check with you actuary or auditor to see what your options are.